Legal risks of outsourcing to India are real, but manageable. Outsourcing to India stays viable for many companies, especially IT and BPO. Problems come when you think a strong contract alone protects everything. Risks mostly from poor governance, not India itself. This guide is for CXOs, legal heads, and compliance leaders. Treat risks as your failures in oversight, like leaving house doors open in a bad neighbourhood.

What usually goes wrong:

- Data privacy mess. If you send personal data, then DPDPA or GDPR apply differently. Vendor breach happens, you pay a fine.

- IP leak or theft. Code designs are shared, but enforcement is slow in courts. An NDA is not enough if there is no clear ownership clause.

- Contract disputes are hard. Jurisdiction unclear, Indian judgment enforced tough abroad. Or tax, GST surprise hit.

- Employment hidden liability. Workers misclassifying or transferring issues trigger local labour law claims against you.

- Cyber and compliance gap. Vendor security is weak, breach exposes you. Or the new RBI rule for finance outsourcing misses.

Check the vendor deeply before signing. Build strong governance—audit regularly, clause tight. Do this, and risks drop much. (Indian law improves, but you control your side.)

IP Protection Risk — When Ownership Exists on Paper but Not in Practice

IP protection outsourcing to India carries risks even when contracts look strong on paper. Many companies think good clauses solve everything, but in practice, ownership often slips away because of execution gaps, not weak Indian law.

Most IP clauses fail because drafting is theory—enforcement is reality. Law exists, courts work, but gaps in the chain kill claims.

Common hidden IP leak points:

- Employees create code or designs outside formal assignments—the company never gets proper transfer.

- Subcontractors get access, then reuse assets elsewhere without clear restrictions.

- Vendor hires freelancers, assignment chain breaks, original creator keeps rights.

| Risk Scenario | What Companies Assume | Legal Reality |

| The developer writes code at home | The company owns automatically | No assignment = developer owns |

| Sub-vendor reuses the component | NDA blocks it | NDA stops disclosure, not ownership shift |

| Employee leaves with knowledge | Non-compete protects | Indian courts rarely enforce broad ones |

Do this to reduce risk: Register copyrights and patents in India when possible. Force written assignments from every person who touches projects (employees, freelancers, subs). Audit vendor processes regularly. Use escrow for critical source code. These operational controls matter more than perfect contract language alone. You must close execution gaps yourself.

Data Privacy & Cross-Border Data Flow — The DPDP Act vs GDPR Reality Gap

Data privacy and cross-border data flow under the India DPDP Act differ from GDPR in real ways, especially for outsourcing. DPDP allows free transfer to most countries—no localisation needed yet, unlike old fears. Breach report mandatory for all incidents to the board and people, no risk check like GDPR (that’s stricter here). Processor liability comes through contract only; fiduciaries carry the main load.

Check this table for client view in India data protection law outsourcing:

| Client Jurisdiction | Expectation | Indian Law Position |

| EU (GDPR) | Adequacy or SCCs, 72-hour breach report if risk | Free flow allowed, all breaches reported anyway—no threshold |

| US (no federal) | Basic security, optional report | Contract must add security, report all breaches |

| Other | Varies | DPDP is lighter on flow, but security is obligatory |

Contracts must explicitly override:

- Add a client-style breach timeline (you report fast).

- Put the processor’s direct liability if the client wants.

- Include onward transfer rules matching client law.

- Define security standards higher than basic. Do this now, or the gap hurts you in the audit. Like locking the door after a thief comes—no good.

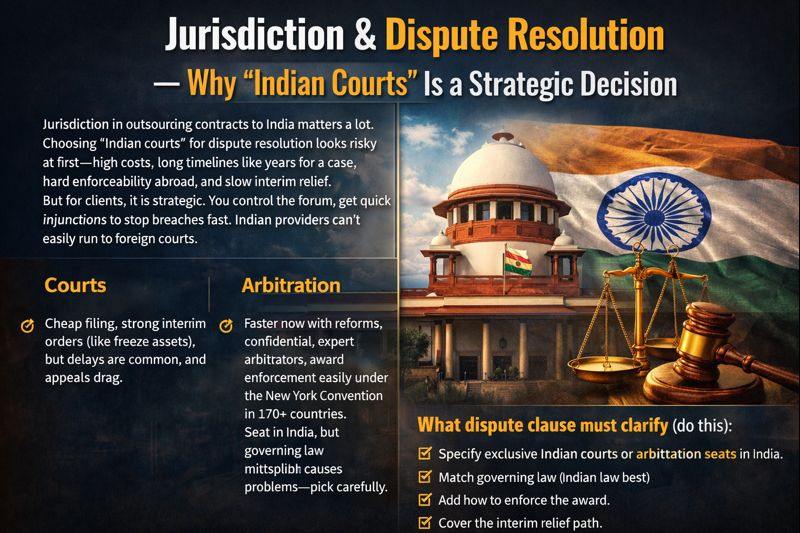

Jurisdiction & Dispute Resolution — Why “Indian Courts” Is a Strategic Decision

Jurisdiction in outsourcing contracts to India matters a lot. Choosing “Indian courts” for dispute resolution looks risky at first—high costs, long timelines like years for a case, hard enforceability abroad, and slow interim relief. But for clients, it is strategic. You control the forum, get quick injunctions to stop breaches fast. Indian providers can’t easily run to foreign courts.

Court vs arbitration trade-offs in India outsourcing:

- Courts: Cheap filing, strong interim orders (like freeze assets), but delays are common, and appeals drag.

- Arbitration: Faster now with reforms, confidential, expert arbitrators, award enforcement easily under the New York Convention in 170+ countries. Seat in India, but governing law mismatch causes problems—pick carefully.

What dispute clause must clarify (do this):

- Specify exclusive Indian courts or arbitration seats in India.

- Match governing law (Indian law best).

- Add how to enforce the award.

- Cover the interim relief path.

This setup protects you in dispute resolution outsourcing to India. Arbitration India outsourcing is popular for balancing speed and enforceability. Check the clause twice.

Tax Exposure & Permanent Establishment — The Risk That Appears After Success

Tax exposure and permanent establishment risk in India outsourcing can hit you hard after your business grows big. Imagine: you start small, outsourcing to India, everything is fine, low taxes. Then success comes, more work, deeper ties—and suddenly the taxman says you have PE there.

PE risk triggers appear like this:

- Your India team signs contracts or negotiates deals for you (not just support).

- Key decisions on prices and clients happen in the India office.

- Long-term fixed place, employees act like they run part of your company.

- Heavy dependence—the project runs for years, and control stays with the Indian side.

Many think GST registration means no PE worry. Wrong. GST is separate, PE brings income tax on profits.

Profit repatriation trap: you pay service fees, think clean. But if PE is found, India taxes attributable profits directly, and double taxation is possible.

Mitigate now. Set contract clear: India partner only auxiliary role. Keep decision authority outside India. Use a limited risk distributor model or safe harbour rules when possible. Review the structure every year as the business scales. Do this before revenue jumps.

Indian Labour Law Compliance — When “Vendor Employees” Become Your Problem

Indian labour law compliance becomes a big issue when vendor employees start to feel like their own. This happens in outsourcing, and creates joint employment risk under India labor law.

Law sees joint liability if you control their work daily – like set hours, supervise tasks, give tools. Then you share responsibility with the vendor. Misclassify them as contractor staff, and the court can say they are your employees. This brings problems: hard termination (need notice, reason), plus statutory benefits like PF, gratuity, and bonus apply to you also.

Red-flag clauses in vendor contract:

- You approve leaves or discipline

- Vendor staff use your email/ID badge

- Long-term placement same person at your site

- You train them directly on the job

Do this compliance check now:

Check the real control level. Put clearly clause vendor is the sole employer. Keep records separate. Audit vendors pay PF/gratuity on time. Train your managers not to supervise vendor staff too much.

Risk is not just a fine, bad reputation, or operation stops if a dispute arises. Fix early, or it becomes your problem fast.

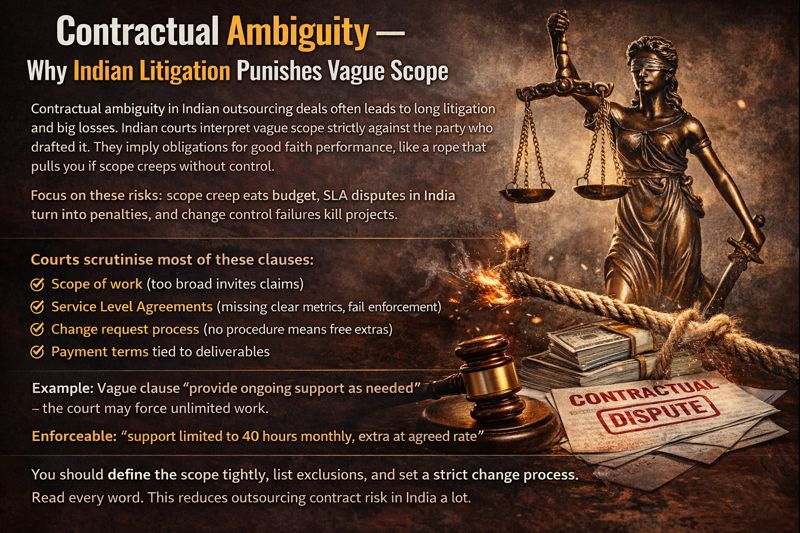

Contractual Ambiguity — Why Indian Litigation Punishes Vague Scope

Contractual ambiguity in Indian outsourcing deals often leads to long litigation and big losses. Indian courts interpret vague scope strictly against the party who drafted it. They imply obligations for good faith performance, like a rope that pulls you if scope creeps without control.

Focus on these risks: scope creep eats budget, SLA disputes in India turn into penalties, and change control failures kill projects.

Courts scrutinise most of these clauses:

- Scope of work (too broad invites claims)

- Service Level Agreements (missing clear metrics, fail enforcement)

- Change request process (no procedure means free extras)

- Payment terms tied to deliverables

Example: Vague clause “provide ongoing support as needed” – the court may force unlimited work. Enforceable: “support limited to 40 hours monthly, extra at agreed rate.”

You should define the scope tightly, list exclusions, and set a strict change process. Read every word. This reduces outsourcing contract risk in India a lot.

Regulatory Change Risk — Outsourcing Contracts Don’t Freeze the Law

Regulatory change risk hit hard in India’s outsourcing contracts. Laws don’t freeze when you sign—changing laws, India forces updates later. Think contract like an old map: road change, you still drive, but get lost easily if not check a new route.

Monitor compliance always. You must watch evolving areas: data protection (DPDP Rules 2025 now enforce strict consent, breach report), IT intermediary rules amendments, and sectoral regs like RBI outsourcing guidelines.

Laws most likely change:

- Digital Personal Data Protection Act/Rules

- IT Rules 2021 updates

- Sector rules (banking, telecom)

Mitigation is simple. Set review cadence—check contract yearly or every 18 months. Add audit triggers: new law notify, then review clause fast (quick parenthetical: include change-of-law term). Provider share monitoring duty. This keeps regulatory compliance in India outsourcing safe. Do this, avoid big penalties. (145 words)

FEMA & Payment Compliance — The Quiet Risk That Triggers Penalties

FEMA compliance in cross-border payments in India hits many companies hard when outsourcing services abroad. You pay foreign vendors for software or consulting, but small finance errors trigger big RBI penalties—even without bad intent.

Common payment mistakes:

- Overpay invoice without a proper reason (pricing must match arm’s length, like fair market).

- Delay remittance beyond terms, or pay late without docs.

- Forget Form A2 declaration at the bank, or wrong purpose code.

- Skip invoice details, no contract backup—so documentation is weak.

- Use unofficial channels, not authorised banks.

Think of it like a leaking pipe: a small drip (delayed reporting) floods the house with fines.

Simple compliance flow: Get a clear invoice and contract first. Check fair pricing. Fill Form A2, submit to the AD bank. Pay on time through the bank. Keep records for 5 years (helps audit).

Do this every time. Saves trouble in FEMA compliance outsourcing to India. Cross-border payments in India need care, with penalties up to three times the amount. You avoid quiet risk.

Subcontracting & Fourth-Party Risk — The Risk You Didn’t Contract For

Subcontracting and fourth-party risk hit hard in India’s outsourcing deals. You sign a contract with one vendor, but they pass work to subcontractors—sometimes without telling you. Then those subcontractors use their own fourth parties. This chain breaks your assumptions on IP protection, data security, and labour compliance.

Why subcontracting escalates risk:

- Undisclosed subs leak sensitive code or customer data (happens often in cost-cutting).

- Fourth parties you never vetted handle your information—no direct control.

- Audit rights stop at the main vendor; the deeper chain stays hidden.

- Indian law applies differently across states, and compliance gets messy fast.

Control it from the start. Insert clear clause: no subcontracting without written approval. Demand a full list of subs and fourth parties. Require flow-down of your security and IP terms. Build the right to audit the entire chain (not just the first vendor). Check this before signing. Do this, or risk grows quiet until breach hits.

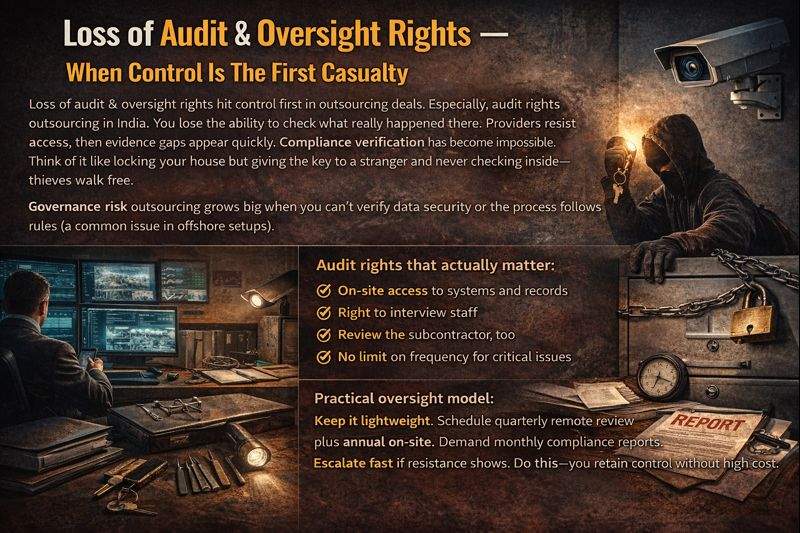

Loss of Audit & Oversight Rights — When Control Is The First Casualty

Loss of audit & oversight rights hit control first in outsourcing deals. Especially, audit rights outsourcing in India. You lose the ability to check what really happened there. Providers resist access, then evidence gaps appear quickly. Compliance verification has become impossible. Think of it like locking your house but giving the key to a stranger and never checking inside—thieves walk free.

This undermines every safeguard. SLAs, penalties, and reports are all useless without proof. Governance risk outsourcing grows big when you can’t verify data security or the process follows rules (a common issue in offshore setups).

Audit rights that actually matter:

- On-site access to systems and records

- Right to interview staff

- Review the subcontractor,r too

- No limit on frequency for critical issues

Practical oversight model: Keep it lightweight. Schedule quarterly remote review plus annual on-site. Demand monthly compliance reports. Escalate fast if resistance shows. Do this—you retain control without high cost.

Final Framework — How Experienced Companies De-Risk Outsourcing to India

Outsourcing risk mitigation in India starts with one rule: legal safety comes from strong governance, not from country location. India is fine if you structure it right. Geography does not decide risk.

Use this 5-point framework-:

- Pick a vendor with a proven compliance record. Check past audits.

- Write contracts clearly on data protection, IP ownership, and liability limits. Including termination is easy.

- Add governance layer — regular audits, joint steering committee, and escrow for code.

- Split work across multiple vendors or sites. Avoid single-point failure.

- Follow both Indian law and your home law. Use arbitration in neutral places like Singapore.

Do this, and the risk drops low. Many big companies have outsourced heavy goods to India for years without a big problem. You can too. Structure matters most.