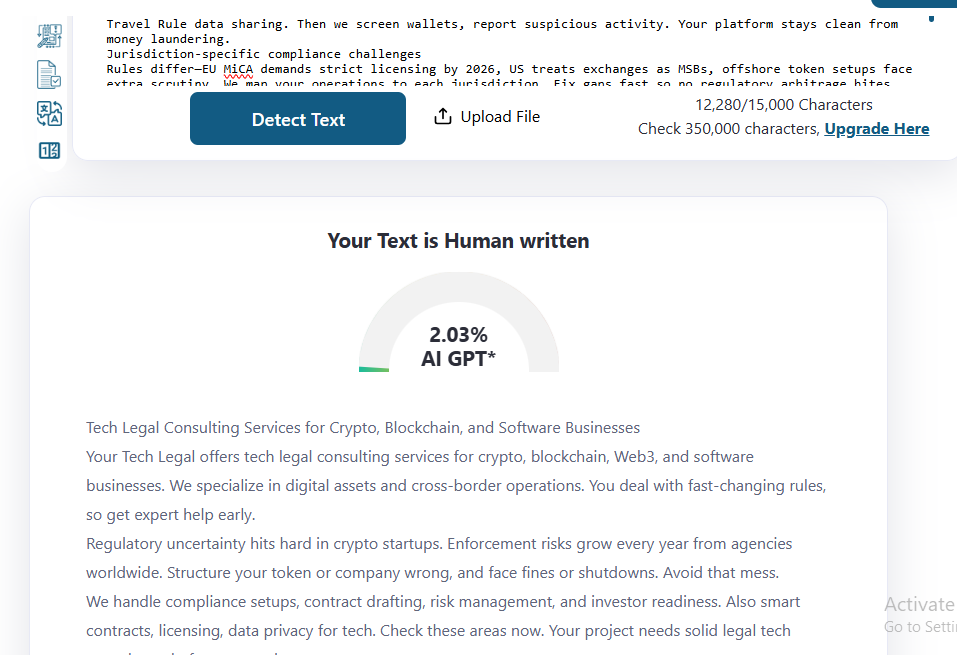

Tech Legal Consulting Services for Crypto, Blockchain, and Software Businesses

What Tech Legal Consulting Means in the Crypto and Web3 Context?

Tech legal consulting in the crypto and Web3 context means specialised advice on blockchain legal compliance, token structures, and legal structuring for crypto startups. You get help with DAOs, smart contracts, licensing in places like Dubai or Singapore, and navigating regs like MiCA or SEC rules. It's not just general IT law. It combines tech know-how with legal expertise to keep projects compliant and scalable.

Why crypto and Web3 require specialised legal frameworks

Crypto moves fast and globally. Traditional laws lag behind blockchain tech and decentralised setups. You face new risks like token classification as securities or cross-border enforcement issues. Get specialised help early to avoid big fines or shutdowns.

Difference between traditional legal advice and tech legal consulting

Traditional corporate law handles contracts, mergers, and basic compliance. But in Web3, it's different.

- Higher risks: Tokens can trigger securities laws and AML/KYC demands.

- Faster speed: Markets change daily, regs evolve quickly.

- Multi-jurisdiction: Projects span countries; no single law applies easily.

- Enforcement hard: Decentralised means disputes are tough to resolve in old courts.

Tech legal consultants understand code and law together. So choose them for your crypto startup. This sets a strong base for growth and deeper compliance work ahead.

Legal Services for Crypto and Blockchain Startups at Different Growth Stages

Legal services for crypto startups change as your project grows. We handle the legal side at every stage. So you focus on building and scaling. We know the budget limits and regulatory risks in blockchain.

Early-stage crypto and Web3 startups

We set up your entity right, often in places like Delaware or offshore, for flexibility. Then assess token risks early to avoid securities issues. We draft founder agreements, basic contracts, and IP assignments. This protects you from day one.

Scaling and fundraising stage startups

We build proper token frameworks and SAFTs for safe raises. Handle investor disclosures and terms clearly. Implement KYC/AML programs that work without slowing growth. You get funds faster, with less risk.

Mature platforms and protocols

We manage cross-border compliance across jurisdictions. Prepare for regular audits and reporting. Build enforcement readiness plans against regulators. Your platform stays strong and trusted long-term.

Crypto Legal Advisory and Token Legal Framework Services

Crypto legal advisory helps projects navigate complex rules around tokens. We structure token legal framework services to lower risks from regulators. You get a clearer path for launch and operations, with less worry about compliance issues.

Token classification and regulatory risk analysis

We review your token design against the Howey test and similar rules. Check if it looks like security or stays as a utility. Then analyse risks in target markets. This way, you avoid heavy SEC or other agency scrutiny early.

Token issuance structuring and documentation

We build utility features into the token from the start. Draft whitepapers, terms, and agreements that emphasise access and use, not profits. Prepare SAFTs or similar if needed. You benefit from solid docs that support non-security arguments.

Offshore and cross-border token compliance strategy

We pick friendly jurisdictions like Cayman or BVI for entity setup. Handle offshore token legal compliance and cross-border crypto legal consulting. Manage AML, KYC across borders. You gain flexibility while staying compliant in multiple places.

| Token Model | Legal Considerations |

|---|---|

| Utility | Focus on platform access; low security risk if no profit promise |

| Governance | Voting rights ok, but watch for central control is |

| Hybrid | Mix utility and governance; higher scrutiny, need careful split |

Blockchain and Smart Contract Legal Compliance Services

Blockchain legal compliance starts with smart contracts. We handle full smart contract legal review, so your code gets real legal enforceability. Code alone does not make a binding contract. We bridge that gap and protect your project from court risks.

Smart contract legal review and risk allocation

- We review the smart contract code line by line. Then we check it against contract law rules like offer, acceptance, and consideration.

- We allocate risks clearly—who pays if bugs appear or exploits hit.

- You get protected liability terms, and we fix vague parts that could cause disputes.

On-chain and off-chain contract alignment

- We align on-chain code with off-chain legal agreements. Hybrid setups work best for complex deals.

- We make sure off-chain parts cover what code cannot handle, like real-world events.

- Your smart contract stays compliant and enforceable across borders.

Liability, upgrade, and dispute considerations

- We build upgrade mechanisms safely, often with governance rules.

- We add dispute clauses—arbitration works well for blockchain cases.

- Liability stays limited where possible, and we plan for errors or breaches upfront. You avoid big losses.

DAO Legal Structuring and Governance Advisory

DAO legal structuring turns your decentralised project into something real-world banks and regulators recognise. We handle the full setup, so your DAO gets limited liability protection for token holders and clear blockchain legal compliance. You operate globally without personal risks, hitting members or founders.

DAO legal wrapper and jurisdiction analysis

We pick the right wrapper—like Cayman foundation, Wyoming DAO LLC, or Marshall Islands entity—and set it up in crypto-friendly spots. Then align on-chain governance with the legal structure. This gives your DAO personhood, easy contracts, and cross-border crypto legal consulting built in.

Governance, voting, and contributor liability

We draft rules that bind voting to the wrapper, limit exposure for contributors, and shield everyone from unlimited liability. Token-based decisions stay enforceable off-chain, too. Your community governs freely, but we protect individuals if things go wrong.

Regulatory risks for DAO founders and operators

We map securities, AML, and tax risks across jurisdictions, structure to minimise them, and keep compliance ongoing. Founders avoid personal fines or partnership treatment. You focus on building— we manage the evolving regulatory side for safe operation.

NFT Legal Advisory and Marketplace Legal Counsel

We take care of all legal sides for NFT projects and marketplaces. You launch with proper protection, no headaches later.

NFT ownership vs IP rights clarification

Most people think buying an NFT means owning the full artwork. Not true. You get the token and maybe a license, but copyright stays with the creator unless we transfer it in writing. We clarify this in contracts so buyers understand exactly what rights they have.

Marketplace terms, creator agreements, and royalties

We write the marketplace terms and creator agreements. These cover licensing rules, royalty splits, and payment flows. Smart contracts handle royalties automatically, but we add legal clauses for enforcement. This keeps creators paid and the platform out of trouble.

Regulatory and consumer protection considerations

Blockchain legal compliance matters more now. We review AML, KYC, securities laws, and consumer rules. For your marketplace, we limit liability and set up dispute processes. You avoid fines and build trust with users.

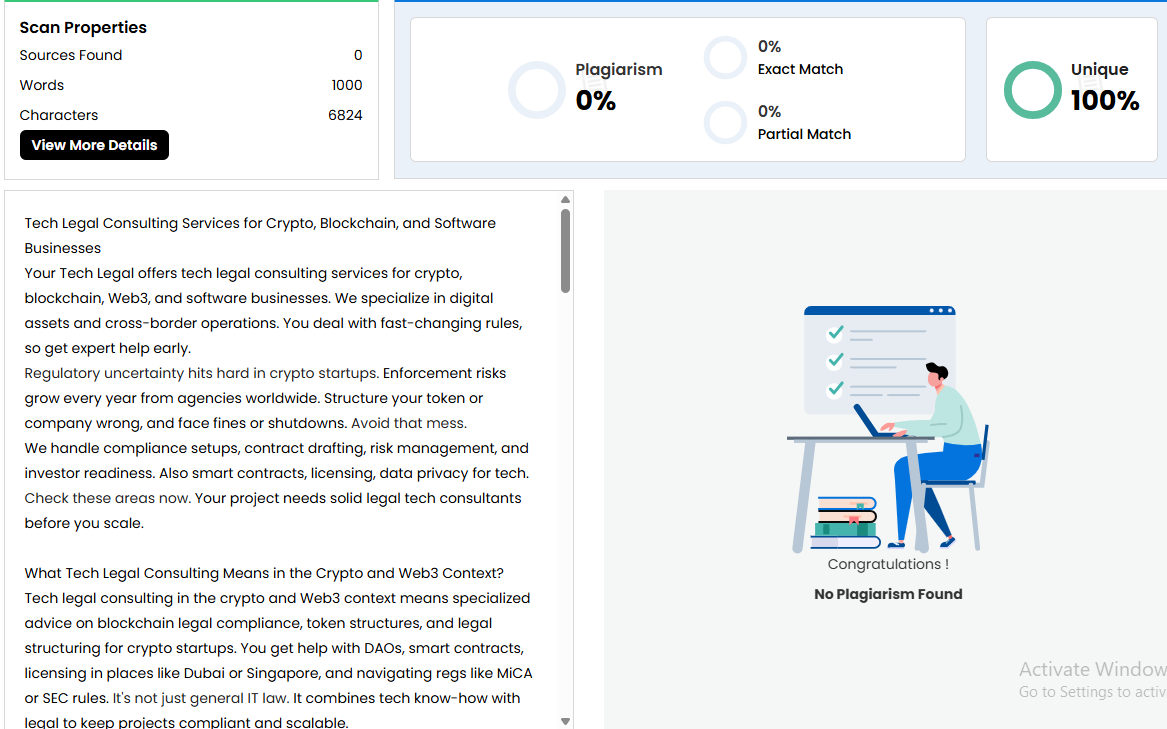

KYC, AML, and Regulatory Compliance for Crypto Platforms

KYC/AML legal requirements for crypto platforms are now core to operations. We handle full compliance so your platform avoids shutdowns and fines. Global enforcement is real—regulators like FATF, MiCA in the EU, FinCEN in the US hit hard on missing checks. You get secure growth without the risks.

KYC and AML obligations for crypto businesses

We set up identity verification and transaction monitoring for every user. This covers FATF standards and Travel Rule data sharing. Then we screen wallets and report suspicious activity. Your platform stays clean from money laundering.

Jurisdiction-specific compliance challenges

Rules differ—EU MiCA demands strict licensing by 2026, the US treats exchanges as MSBs, and offshore token setups face extra scrutiny. We map your operations to each jurisdiction. Fix gaps fast so no regulatory arbitrage bites you.

Regulatory reporting and audit readiness

We build ongoing monitoring and record-keeping systems. Prepare SAR filings and proof of reserves when needed. Audits come smoothly.

- Verify all users with documents and biometrics.

- Monitor chains for illicit flows daily.

- Report to authorities on time.

You focus on building the platform. We make compliance operational and invisible. Blockchain legal compliance done right means no surprises.

Legal Due Diligence and Structuring for Web3 Investors

Legal due diligence before token or equity investment.

We check token classification first. Is it a security or a utility? Then review smart contracts, audits, and team backgrounds. This spot regulatory gaps and helps avoid big losses from non-compliant crypto startups.

Red flags investors should identify early.

Anonymous teams or no audits raise alarms. We dig into hidden sanctions links, past scams, or vague tokenomics. You benefit as we flag these fast, so your investment stays safe from rug pulls or fraud.

Structuring investments to manage downside risk.

We build legal wrappers like SAFTs or offshore entities. Add vesting and governance rules. This limits exposure in volatile Web3 deals and gives you better exit options through proper legal structuring for crypto startups.

Why Choose Us

Why Choose Our Tech Legal Consulting Team

Information

Frequently Asked Questions